Willow Lodge

Simon Johanson, Property Editor for The Age, recently (3 March 2015) published an article in the Sydney Morning Herald entitled ‘Fee shock pushes pensioners to take on retirement industry’.

14 retirement village residents, aided by the Consumer Action Law Centre, are taking village operator Walter Elliott Holdings to the Victorian Civil and Administrative Tribunal (VCAT).

You can read the article here: http://www.smh.com.au/business/property/fee-shock-pushes-pensioners-to-take-on-retirement-industry-20150303-13tl3e.html

The village, Willow Lodge, is in Melbourne’s outer eastern suburbs.

According to the article, the 14 pensioners are asking that VCAT declare their contracts void. They allege the fees are unfair in contract terms.

The article outlines a number of issues:

- They claim the fees are unfair in contract terms

- The contracts failed to offer opportunity for negotiation

- The contracts did not take into account their circumstances

- The retirees in question were pensioners, retired, elderly, not tertiary qualified and lacked commercial or business acumen.

Whenever I read an article like this one, I ask two questions:

- Does this problem apply to other retirees?, and if so

- How can the problem be avoided?

Does this problem apply to other retirees?

Does this problem apply to other retirees? Yes, it does! If we look at the characteristics of the 14 retirement village residents represented in this case we know that they are:

- Retired

- Pensioners

- Elderly

- Not tertiary qualified

- Lacking in commercial or business acumen

So, let’s see what the data tells us about the average retirement village purchaser.

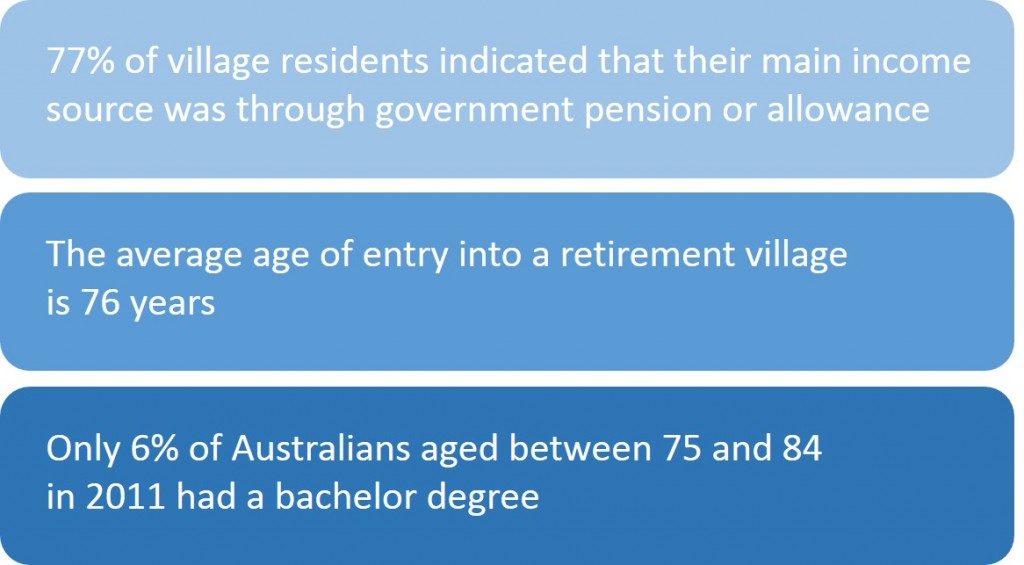

77% of retirement village residents indicated that their main income source was through government pension or allowance (Source: McCrindle Baynes Villages Census Report 2013 Executive Summary)

The average age of entry into a retirement village is 76 years (Source: The McCrindle Blog)

Only 6% of Australians aged between 75 and 84 in 2011 had a bachelor degree

(Source: Australian Bureau of Statistics – Reflecting a Nation: Stories from the 2011 Census, 2012-2013)

It’s difficult to make judgements on the average retirement village resident’s commercial or business acumen. Data from the Australian Bureau of Statistics tells us the following.

For those who studied beyond school level, common fields of study for ‘older persons’ included:

- Carpentry and Joinery

- Metal Fitting and Turning and Machining

- Vehicle Mechanics

- Building

- Plumbing

- Boilermaking and Welding

- Garment Making

- Hairdressing

- Midwifery

(Source: Australian Bureau of Statistics – Reflecting a Nation: Stories from the 2011 Census, 2012-2013)

These people may have run successful businesses for many years and have significant business acumen. Alternatively, they may have only limited business acumen.

In the article, Gerard Brody, the Chief Executive of Consumer Law, also talked about residents signing long and complex contracts at times in their lives when they had undergone enormous personal upheaval.

This is certainly backed up by the 2013 Villages Census Report. This report states:

The top 3 reasons retirees who had recently purchased a retirement village home gave for leaving their previous home were:

- to downsize while they could (84%),

- their home was becoming too big to manage (62%), and

- concern about my future health (60%).

In fact, 48% of recent retirement village residents had a significant health incident prior to moving to the village. That health incident either somewhat or strongly influenced their decision to move into the village.

This clearly shows that a large number of potential retirement village residents fall into exactly the same category as the 14 pensioners suing Willow Lodge.

It will be interesting to see the outcome of this case.

Knowing only what is stated in the Sydney Morning Herald’s article, it appears that these pensioners may find it difficult to prove that they are any different from the average retirement village home buyer.

I feel for them. My mother-in-law purchased a retirement village home and she’s still coming to terms with her contract.

So, how do other retirement village residents feel about the fees they’re required to pay?

The 2013 Villages Census Report tells us the following:

39% of recent purchasers regarded the deferred management fee as an unreasonable fee

37% accept that it is a reasonable fee

13% state they do not understand it

This indicates that retirement village purchasers don’t understand the contracts they’re signing.

The 2011 Villages Census Report had an even more interesting statistic.

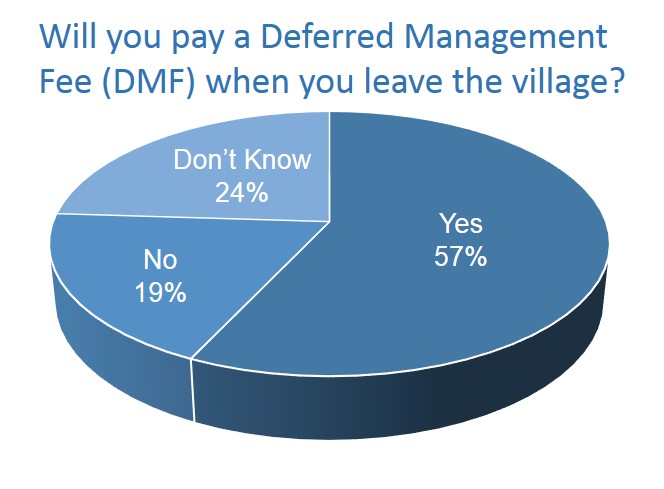

When residents were asked “Will you pay a Deferred Management Fee (DMF) when you leave the village?” they responded as follows:

So, 24% of residents didn’t know whether they had to pay a deferred management fee. They didn’t know whether they owed their retirement village thousands of dollars! This is current retirement village residents, living in a retirement village!

Not only that, 19% of surveyed residents thought they didn’t have to pay a DMF – which is really alarming, because given the retirement village industry models currently available, that is highly unlikely! There are a lot of residents in for a very big shock at some time in their future.

So, how can prospective retirement village home buyers avoid this problem?

Before we answer this question, let’s consider what these 14 pensioners are asking VCAT do.

They are asking that their contracts be declared void. What will this mean for the retirement village?

Willow Lodge has 409 permanent sites. If 14 people have their contracts declared void, what will the remaining residents do? Will this mean a precedent has been set, not just for Willow Lodge, but for other retirement villages? Could the financial viability of Willow Lodge, and potentially all retirement villages be affected? How will this affect current and future residents?

How can the problem be avoided?

I think the key lesson here is that these contracts are complicated. You need to educate yourself before entering into an agreement for a retirement village property.

To some extent, these documents are necessarily complicated. These are not simple transactions. These contracts have to outline the rights and responsibilities of both parties in a fairly sophisticated financial transaction.

That’s not to say that we don’t believe there is room for improvement. These documents should be simplified. There is significant evidence showing that the people entering into these agreements do not understand them. And that’s alarming.

This is where The RetireEase System can help.

We have developed a video course, in easy to understand language, explaining how to negotiate this complex process. It’s excellent value for money, priced around the cost of the average book.

From the comfort of your very own home, you can work your way through this complex process in an afternoon. Alternatively, you can take your time, watch a video a day, and take a fortnight or more.

The point is, you can do it in your own time, at your own pace, in your own home.

Retirement village life is great. My mother-in-law loves her new lifestyle. But do your research. And do it the smart way and do it the easy way!

To find out more, go to www.retirementvillageinfo.com.au.

Congratulations on your website. Retirement village living could be a good lifestyle but is needlessly impacted by greedy and arrogant operators such as AVEO. AVEO should not be putting its Newmarket residents through this stress at this stage of their lives. It is a blatant betrayal of their advertising promises. We have issues here with AVEO but it is frustrating that we have nowhere to air these problems. Your website could be a breath of fresh air to oppressed village residents as well as a warning to intending village residents.

We have only just begun our quest to find a Village. I have Googled and read myself through a hugely diverse range of commentary on the subject, the vast majority of which is heavily flavoured by and in favour of the Industry. I find your writings a breath of understandable sanity in the whole thing. Thank you. We will continue to look for what we would like just in case something is out there that will meet our needs. We will do so substantially less blinded than we were thanks to your work.