RETIREMENT VILLAGES MELBOURNE

How to get the best possible deal on a retirement village home in Melbourne and how to avoid making one common mistake that could cost you thousands!

Retirement Villages Melbourne is the most popular search in google when people search for retirement villages in a particular city or state.

So, what exactly are you looking for when you type Retirement Villages Melbourne into google?

Clearly, you’re searching for retirement villages in Melbourne, but what specific information would help you get the best possible deal on retirement villages in Melbourne?

The first thing I’d suggest you look at is the legislation governing retirement villages in Melbourne. And there’s some good news here!

Melbourne retirement villages are subject to the Retirement Villages Act 1986. This legislation underwent some changes a few years ago that will work to your advantage!

To see the Act in full, click here.

If you’ve watched our video, “How to get the BEST POSSIBLE DEAL on a home in a retirement village PLUS: How to avoid the single, BIGGEST MISTAKE, made by up to 80% of Retirement Village home buyers, that costs them thousands”, you’ll know the single biggest mistake that many retirement home buyers make.

The good news is that the Retirement Villages Act 1986 may offer protection to SOME, but NOT ALL, buyers that make this mistake!

If you haven’t watched our video yet, click here to watch it now. Afterwards, return here to get more information, specific to getting the best possible deal on retirement villages in Melbourne.

So, let’s get into some detail.

We now know that the majority of retirement village residents leave their retirement village home to move into a facility with a higher level of care.

At this time, typically, you have to pay a bond to enter the high care facility. In order to pay this bond, most retirement village home owners must sell their retirement village home.

So, what happens if you can’t sell your retirement village home? If you’ve watched the video (see above) you’ll know what happened to Vi, and what could happen to you.

The vital lesson to learn here, for people looking at retirement villages in Melbourne, is to carefully consider your contract type! Remember, this information is specific to people buying retirement village homes in Victoria.

Typically, Australian’s like to ‘own’ their own home. When you buy a home in many retirement villages, rather than buying the home outright, you can often purchase the right to occupy the premises.

This might sound alarming, but it actually has some advantages, such as avoiding the payment of stamp duty!

However, there are more advantages (and more money to be saved), particularly for those buying into retirement villages in Victoria.

The good news for those of you googling Retirement Villages Melbourne, is that the Retirement Villages Act 1986 now offers the following protection for residents who do not own their retirement village unit (i.e. those on loan/lease or loan/licence type contracts where you have bought the right to occupy the premises).

If a retirement village unit does not change hands in time for the resident to get their exit entitlement before the aged care bond is due, the retirement village owner must lend the resident, without charge, whichever is less:

- Their full entitlement, or

- The full amount of the aged care bond

Please note that this does NOT apply to those people who bought their retirement village on a strata title contract.

Additionally, this law only applies to people who signed their retirement village contract after 15 September 2006.

Lastly, remember the Retirement Villages Act 1986 only applies to Victorian retirement villages.

To read the applicable legislation in full, refer to the Retirement Villages Action1986: Section 26 Refund of in-going contribution.

If you watched our video (see above) you will also know that retirement villages can continue to charge you some fees and charges even after you have left the retirement village. These fees are sometimes payable until your retirement village unit sells. This typically takes longer than selling a normal home and can take years.

Once again, the Retirement Villages Act 1986 may offer protection to SOME, but NOT ALL, buyers who find themselves in this position.

The Act now offers the following protection for residents who do not own their retirement village unit (i.e. those on loan/lease or loan/licence type contracts).

If you are a non-strata resident, maintenance fees for general services to the retirement village community, such as repairs, must stop within six months. During this six-month period, the retirement village must stop charging you recurrent fees when either the unit you have vacated is re-occupied or someone enters into a contract to occupy it.

Remember, this only applies to those residents who do not own their retirement village unit.

To read the applicable legislation in full, refer to the Retirement Villages Action1986 Section 38B Maintenance charges – former non-owner residents to see the information in full.

So far this article has shown you how you can:

- save thousands of dollars in stamp duty, and

- save finding yourself in the horrific situation of needing to move to higher level care, but not being able to afford your accommodation bond,

- save paying on-going maintenance fees until your retirement village home sells!

At www.retirementvillageinfo.com.au we’re all about offering non-biased advice to retirement village home buyers.

After talking to many residents, what we find is that the ‘soft’ decisions, that won’t save you thousands of dollars, are also very important.

Why are you googling Retirement Villages Melbourne?

One reason people choose to move, is to be closer to friends and family.

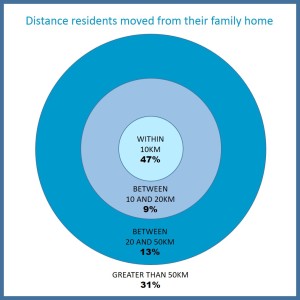

In the McCrindle Baynes Villages Census Report 2013 we read that more than half of the village residents interviewed moved more than 10 kilometres from their previous home to their current village residence.

31% moved more than 50km.

If you’re moving to be closer to friends and family, are they planning to stay in their current location long-term? Have you discussed your decision with them?

Are there sufficient services available near the retirement villages you’re considering?

Fortunately, Melbourne, as a large city, is well serviced with hospitals, public transport and the infrastructure that becomes important as we age.

If you would like to know more of the vital questions to ask before buying your retirement village home, download our free Retirement Village Checklist (see below).

This 6-page checklist will make sure you ask the RIGHT questions to avoid costly hidden fees and unpleasant surprises when buying a retirement village home.

If you haven’t watched our video “How to get the BEST POSSIBLE DEAL on a home in a retirement village PLUS: How to avoid the single, BIGGEST MISTAKE, made by up to 80% of Retirement Village home buyers, that costs them thousands”, please, do that now.

I wish you luck in your search for retirement villages in Melbourne and a long and happy retirement!

Hi, great site and valuable information but the links to the video and Act (404 fault message) don’t work. I can get the Act etc. elsewhere but would really like to see the video. I also requested the 6 page check list, is it still available?

Cheers

Peter

Hi Peter, thanks so much for your kind comments. You should have your 6 page checklist now (we send them out every couple of days) and the links should all be working now. If you have trouble with the link to the video, you can find it directly by visiting https://www.retirementvillageinfo.com.au. Thanks again! Deborah

We have only just begun our quest to find a Village. I have Googled and read myself through a hugely diverse range of commentary on the subject, the vast majority of which is heavily flavoured by and in favour of the Industry. I find your writings a breath of understandable sanity in the whole thing. Thank you. We will continue to look for what we would like just in case something is out there that will meet our needs. We will do so substantially less blinded than we were thanks to your work.

Thanks so much for your kind comment Peter. I hope you enjoy The RetireEase System. Kind regards, Deborah